The term ‘e-invoice’ stands for ‘electronic invoice’, i.e. an invoice that is issued, transmitted and received electronically. This enables the fully digital processing of all steps from issuing the invoice to payment. The faster processing and lower processing costs are advantages over conventional paper invoices. Incidentally, an invoice in PDF format is not considered an e-invoice.

Well-known electronic invoice formats are ZUGFeRD and XRechnung. An ‘X-Rechnung’ is a specific standard for e-invoices that was originally developed for public administration and is still prescribed there today. It is based on the European standard EN16931 and the EU Directive 2014/55/EU. This standard defines the requirements for an e-invoice within the European Union. The X-bill is based on the XML format. This enables simple, automatic processing and integration into existing systems. ZUGFeRD, on the other hand, is a hybrid format that combines a PDF file with embedded XML data. This enables both machine processing and human readability. ZUGFeRD also complies with EU Directive 2014/55/EU.

The legal requirements and digital reporting obligations for electronic invoices in Germany are comprehensive and aim to promote transparency, efficiency and compliance in finance and accounting. The European Commission’s reform proposal aims to modernise the current VAT system and further curb VAT fraud in the EU. This results in two obligations in the B2B sector: the e-invoicing obligation and the digital reporting obligations. We would like to discuss these in detail below.

The European Commission’s reform proposal states that the receipt and processing of e-invoices in the B2B sector will be mandatory from 1 January 2025. This is to be made possible without prior consent. The basic obligation to issue an electronic invoice will also apply from 1 January 2025.

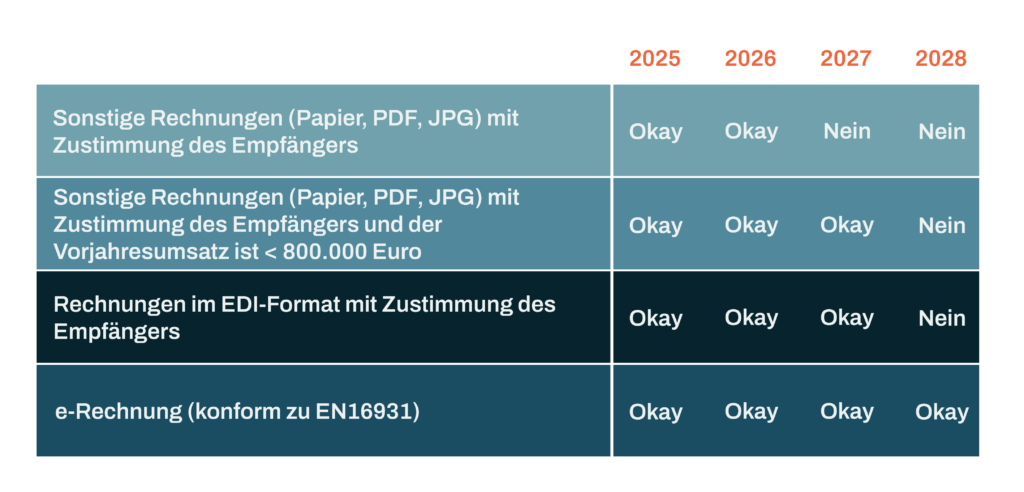

However, there are some transitional regulations for the years 2025 to 2027, taking into account the expected high implementation costs for companies.

The following obligations and transitional periods apply for the next few years:

Switching to electronic invoicing using e-invoicing offers other advantages for companies in addition to compliance with the Invoicing Ordinance. For example, they benefit from more efficient handling of their business processes, accelerated payment processing and a reduction in operating costs. This increase in efficiency is achieved through the automation of various processes, which not only reduces the susceptibility to errors, but also increases transparency within the financial flows.

The introduction of digital reporting obligations is planned for 1 January 2028. This step is intended to modernise the EU’s VAT system in order to better combat VAT fraud. This will result in the obligation for entrepreneurs to report their B2B sales via a standardised reporting system. In addition, this measure also requires that every invoice is issued and transmitted electronically.

This development follows the Growth Opportunities Act announced in the Federal Law Gazette on 27 March 2024, which marks the end of paper invoices. As mentioned above, e-invoicing will be mandatory from 1 January 2025. This affects both small and large companies.

There are exceptions to the e-invoice obligation for small-value invoices under 250 euros in accordance with Section 33 UStDV and for tickets in accordance with Section 34 UStDV. In addition, invoices to consumers, i.e. B2C, are not affected by the obligation.

There are transitional regulations for the complete introduction of e-invoices, which allow for gradual implementation. You can find an overview of these regulations in the table above. This shows that in the period from 1 January 2025 to 31 December 2026, companies will initially still be able to issue and receive paper invoices and electronic invoices that do not yet meet the new requirements. However, the priority of paper invoices will already be cancelled at this time. The consent of the service recipient is no longer required to accept EN16931-compliant e-invoices.

After 31.12.2026 and until 31.12.2027, the transitional regulation will change again. The simplification for invoicing will then be limited to invoicing companies with an annual turnover of less than 800,000 euros. In addition, a separate transitional period until the end of 2027 applies to companies that already use existing EDI connections.

Both X-Rechnung and ZUGFeRD are e-invoices within the meaning of EU Directive 2014/55/EU. The national version of the EN-16931 standard, which specifies the use of the XML structured data format for electronic invoice exchange, is the X-Rechnung e-invoice format. In contrast, ZUGFeRD is a cross-industry data format for the electronic exchange of invoice data. This data format was developed by the Forum elektronische Rechnung Deutschland (FeRD) with the support of the Federal Ministry for Economic Affairs and Energy. ZUGFeRD is used in B2B, B2G and B2C business transactions.

To fulfil the legal requirements for e-invoices, you can use the tried-and-tested SAP product ‘SAP Document and Reporting Compliance, Cloud Edition’. With this solution, electronic documents and required reports can be transmitted between business systems and external communication partners. The Cloud Edition offers a dedicated process for every business scenario that requires an exchange of information between systems. You can thus implement the local requirements for electronic invoices in Germany in your SAP system.

The biggest difference between a scanned paper or PDF invoice and an e-invoice is that an e-invoice is an invoice issued in a structured format in accordance with the EU standard. It is transmitted and received electronically and also enables automatic and electronic processing without media disruptions. Unlike a paper or PDF invoice, it is designed as a purely semantic data format. This means that invoice data can be imported directly into the processing systems without media discontinuity. It is also based on an XML format, which is primarily used for machine processing and is not suitable for visual inspection. Visualisation programs can be used so that the e-invoice can also be read by humans.

Compliance with the GoBD when using EN16931-compliant e-invoices is crucial, as it not only ensures compliance with tax regulations, but also improves the efficiency and transparency of accounting processes.

In Germany, e-invoices must comply with the provisions of the German Value Added Tax Act (UStG) and the principles for the proper keeping and storage of books, records and documents in electronic form and for data access (GoBD). The requirements of EU Directive 2014/55/EU also apply.

Yes, electronic invoices are legally equivalent to paper invoices, provided they fulfil the legal requirements, in particular with regard to authenticity of origin, integrity of content and legibility.

Permitted formats for e-invoices in Germany include ZUGFeRD (Central User Guide of the German Electronic Invoice Forum) and XRechnung. These formats are standardised and support compliance with legal requirements.

E-invoices can be transmitted securely via networks such as PEPPOL (Pan-European Public Procurement Online), e-mail with encryption or secure web portals. SAP Document and Reporting Compliance supports both sending via the PEPPOL network and by e-mail.

Benefits of eInvoices include faster processing times, lower costs for printing and mailing, improved accuracy and error reduction, easier archiving and faster retrieval, as well as a positive contribution to the environment through paper savings.

UNIORG supports you not only with the technical implementation of SAP Document and Reporting Compliance, but also with the provision of training, the creation of user manuals, the customisation of your SAP processes and ensuring compliance with legal regulations. We bring expertise and experience to ensure a smooth and efficient implementation of eInvoices in your SAP system.